Sanderson Abel

Sanderson Abel

Bank lending is evolving fairly rapidly in light of changing global and domestic financial conditions and the advent of technology which continues to revolutionise banking and financial services.

Significantly, the more many aspects of bank lending are changing, the more others endure, seemingly unencumbered by both time and evolving economic, financial and technological conditions.

The requirement for collateral as security is one aspect that has defined the fundamentals of the practice of bank lending, either directly or indirectly.

The requirement for collateral is rooted in the timeless banking principle of probability of an event – the probability that a borrower may default and the associated Value at Risk – core fundamental principles that have defined banking and risk management since the foundations of banking practice.

Banks are custodians of depositors’ funds, and using these (typically) short term liabilities, they create assets through lending, thus the term positive asset transformation.

The vector of positive asset transformation has a combination of two known quantities and a third unknown variable, hence the issue of probability and with it collateral as security.

It is known that bank deposits belong to customers. It is known that these can be profitably transformed into longer term assets through lending.

What is not known with complete certainty is the repayment of funds borrowed, in other words the performance of the asset created.

All assets created by a bank (loans and advances) have a probability profile, ranging from very low to high probability of performance.

These probability outcomes are a function of many other factors, some economy wide, others industry specific while yet others are uniquely loan specific, creating a probability density function for any asset portfolio, which varies according to underlying asset performance.

Banks have no way of knowing in advance, which particular asset may or may not perform and they must, out of prudence have a fallback position in case of nonperformance. That fall back is security, hence collateral.

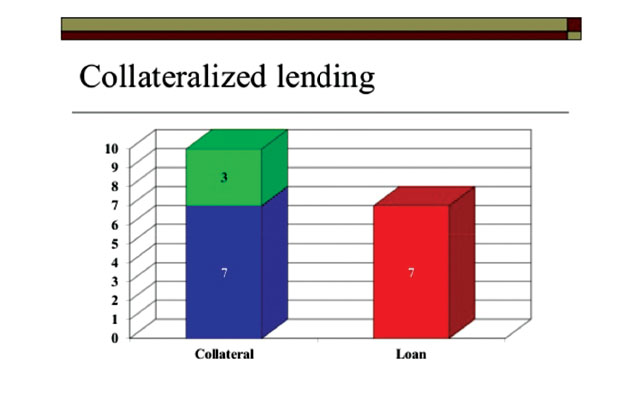

A secured loan is one that has collateral attached to it. Ordinarily, this type of loan generally has a comparatively lower interest rate because the bank is taking a lower risk because the Bank can call upon the collateral in the event of default.

Security safeguards depositors’ funds. Banks are increasingly lending on the basis of the credit worthiness of a project, but most do not diminish the relevance of collateral, so that the debt is thus secured.

In the event that the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or the entire amount originally loaned to the borrower.

Collateral, particularly, immovable property grants a lender a portion of the bundle of rights to specified property.

Banks are however not per se trigger happy, foreclosure is typically the last recourse after the bank has tried all other available means to get repayments without success.

There are several types of secured loans. Mortgages, equipment purchase and car loans are the most common types of loans.

One can also get a secured credit card by attaching a Certificate of Deposit (CD) to a credit card. Banks will do this for customers who are trying to rebuild their credit history.

The credit limit will be about the same amount as the CD and in the event of default the bank takes money from the attached CD.

Collateral is something of value – an asset or property – that is pledged when getting a loan. In the event of default, the lender can take collateral and sell it.

A diverse range of assets qualify as collateral. Physical assets like houses and cars may be used, and intangible assets like bank accounts and investment holdings might qualify depending on loan type.

Unsecured loans are not attached to any collateral and these are loans that are primarily small amount loans used to cover home improvements, small purchases or to cover unexpected expenses.

They are unsecured loans because the bank has nothing to go after if the borrower defaults. Because they are just taking your word for it, you have to have decent credit to get an unsecured loan.

Unsecured loans are sometimes called ‘signature loans’ because the bank has nothing but your signature.

In other words they can’t take possession of your house, car, or other belongings in the event that you default.

However, they can report a defaulting client to the credit reporting companies and affect your credit history.

Why collateral?

If you risk losing something, why pledge it as collateral? It may be because there is no other way to get a loan.

Banks won’t lend you enough money to buy a house unless they can take the house back and sell it when things go wrong, leading to payment default.

By extending the loan through securing the debt, the creditor is relieved of most of the financial risks involved because it allows the creditor to take the property in the event that the debt is not properly repaid.

Debtors receive loans on more favourable terms than available for unsecured debt, or to be extended credit under circumstances when credit under terms of unsecured debt would not be extended at all. The creditor may offer a loan with attractive interest rates and repayment periods for the secured debt.

Collateral is important because lenders want to have some input in the game. They’re taking a risk so they want the borrower also assume some risk as well. Large loans and borrowers without a solid credit history are most likely to need collateral.

Lenders define collateral requirements; if you can’t meet them you may have to pay higher rates or find another lender.

Secured loans are an excellent way to work towards building your credit score. Banks like them because there is risk mitigation.

A borrower must be careful as to the choice of what to use as collateral most banks require a home or a car in order to give the loan, although a savings account may work, but you will not be able to access that money for the entire duration of the loan.

One potential problem with collateral is that if a borrower is unable to pay off a loan as scheduled, the assets used as collateral will be seized and sold, and the money raised by selling the assets will be used to offset the loan balance.

However, the market value of the collateral depends on factors outside the control of both the lender and the borrower.

In such instances, if it so happens that the collateral value does not liquidate the loan balance leaving the borrower exposed and still liable to the lender for the difference.

- Sanderson Abel is an economist. He writes in his capacity as senior economist for the Bankers Association of Zimbabwe. For your valuable feedback and comments related to this article, he can be contacted on [email protected] or on numbers 04-744686 and 0772463008