How VAT on basic commodities impact local firms

Industry Minister Mike Bimha

THE Zimbabwe Revenue Authority last year saw its gross revenue collections missing the target by four percent, registering collections of US$3,5 billion, compared to the targeted US$3,6 billion. This was against increasing expenditures which surpassed the targeted levels. That left treasury with an excessive fiscal deficit.

The 2017 National Budget, presented on December 8 2016, was therefore crafted with a deliberate thrust of attempting to rationalise expenditure while additional measures are instituted to increase revenue. In one its revenue collection measures, the National Budget noted that rationalisation of the schedule of VAT zero-rated and exempt goods and services remains one of the priority areas with focus on broadening the tax base and minimising the cost of administration. The same budget then proposed to standard-rate the following products which were previously VAT zero-rated: rice, margarine, cereals, mahewu, pork, beef, fish, chicken and potatoes.

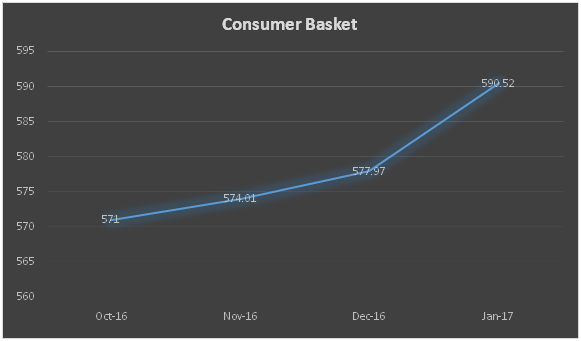

That resulted in the gazetting of Statutory Instrument 20 of 2017, which came into effect on 1 February. For that reason, one should dismiss the Consumer Council of Zimbabwe’s assertion that the January cost of living rose due to the 15 percent VAT on the above products. The VAT will only start to be felt this month going forward, unless firms just effected the increases based on anticipation of tax increase. But the measures were announced early December last year and, if prices were going to be increased by firms basing on anticipation of VAT increase, then prices would also have significantly gone up in December 2016.

CCZ/FinX

That being said, prices for the above VAT standard rated products will now start to go up, as has already been happening. Firms cannot absorb all those costs and therefore pass the biggest chunk of the tax portion to the consumer. Some also take advantage of the situation to increase their prices unjustifiably.

We are also going to start to witness a substitution effect, as people reduce consumption of these products – maybe soya mince and beans instead of meat, peanut butter in place of margarine, mealie porridge instead of cereals, and so on. The increase in the price of these VAT rated products will increase the demand of their substitutes.

But what is more worrying about the VAT introduction on the above products is that it is affecting the things that are consumed daily and which safeguard the nutrition of children and adults. Under Zim-Asset, one of the four pillars of the policy is dedicated towards Food and Nutrition Security. Some of the key cluster outcomes under nutrition are “improved enabling legal, policy and food and nutrition regulatory environment” and “reduced stunting levels of children”. A regulatory environment that deliberately causes prices of goods to go up is therefore against the spirit and letter of Zim-Asset.

It is also now difficult for other protective measures which were put in place last year to promote the growth of local productive sectors to grow to make any meaningful impact, given the VAT increase on the above basic commodities. It’s more like government has given with one hand and tookit all away with the other. Most of the products that have been subjected to standard VAT under SI20 of 2017 were also protected under SI64 of 2016 and other legislations passed last year. Cereals and mahewu were protected from imports in SI64, while potatoes were protected under the suspension of importation of agricultural produce which was imposed by Cabinet last year.

Companies that are protected need to be further supported with local measures that promote competitiveness. The imposition of VAT on protected products will therefore make them very uncompetitive and might actually encourage the smuggling of imported substitutes through our already porous ports of entry. The objectives of protection will also not be achieved under such circumstances. It is also ironic that government is however willing to grant zero percent corporate income tax to foreign investors who are coming to invest in special economic zones, while punishing already established local companies that have been protected to resuscitate.

This is also happening at a time when most companies are facing challenges in accessing the hard currencies for the importation of key raw materials with their banks also failing to settle their international payments on time. Some have been compelled to resort to the black market where they pay a premium of up to 20 percent, a bigger portion of which is again passed to the final consumer. There is also pressure on electricity tariffs being increased this year, if pronouncement by the Minister of Energy and Power Development Minister Samuel Undenge are anything to go by.

This is despite the fact that the 2017 National Budget imposed a freeze on all remuneration and benefits for boards and executive management of parastatals and local authorities. That remuneration freeze was supposed to be complemented with a general freeze on tariffs, including electricity. If prices of goods and tariffs for services such as electricity are deliberately made to go up, that might leave the real consumption levels of employees from parastatals depleted. They will feel betrayed by the social contract that government was trying to enforce and will be tempted into corrupt tendencies.

There are many forces that are compelling the cost of doing business to deteriorate this year. Government must not worsen the situation by implementing measures that might worsen the situation. SI20 of 2017 should be revisited. FinX