Prosper Ndlovu, Business Editor

DESPITE the dampening Covid-19 pandemic, Zimbabwe’s economy is on a “strong rebound”, as the Treasury yesterday revised upwards the country’s Gross Domestic Product (GDP) growth projections to 7,8 percent, slightly above the 7,4 percent target announced in the 2021 National Budget Statement.

Compared to latest global economy growth projections at average six percent in 2021, from an initial forecast of 0,5 percent, Zimbabwe is poised to register one of the solid gains compared to regional peers.

The country’s outlook is more than double that of the Sub-Saharan region’s projected growth of 3,4 percent in 2021.

Anchored on the successful 2020/21 rainfall season, higher international mineral commodity prices and a stable macro-economic environment, Zimbabwe’s enhanced resilience from prevailing shocks has been buttressed by the comprehensive fiscal consolidation measures implemented to date.

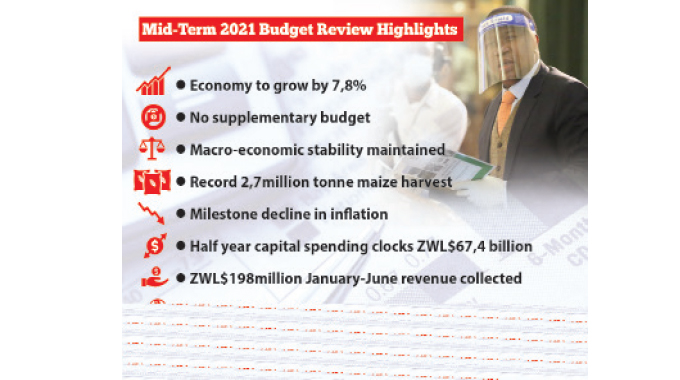

Finance and Economic Development Minister, Professor Mthuli Ncube said this while presenting his Mid-Term 2021 National Budget Review statement in Parliament, where he ruled out the need for a supplementary budget this year.

The minister also noted that Government’s prudent planning and co-ordination of the Covid-19 response measures, coupled with the vaccination exercise currently underway globally and domestically, continue to give hope to the sustained economic recovery.

“The domestic GDP growth for the year 2021 is projected to remain strong at 7,8 percent, slightly above the 2021 National Budget growth forecast of 7,4 percent,” said Prof Ncube.

“Despite the ragging global pandemic, implementation of the NDS1 through the 2021 National Budget remains on course, following a favourable farming season, recovery in the manufacturing sector and firming international commodity prices.

“The recovery will mostly be supported by firm international commodity prices, spill-over effects from global growth, and some supportive fiscal and monetary interventions.”

With continuing fiscal support measures, the Treasury boss said higher growth rates were projected in agriculture, electricity generation, accommodation and food services, as well as financial services.

He stated that the fiscal and monetary consolidation measures being implemented by Government to date, have firmly anchored inflation expectations, as shown by a significant decline in inflation from 837.5 percent in July 2020 to 106.6 percent in June 2021. This week Zimstat reported the July year-on-year inflation had narrowed to 56.37 percent and 2.56 percent month-on-month.

“Month-on-month inflation is expected to remain stable at less than three percent during the second half of 2021. Consequently, annual inflation is expected to decline further by the end of August 2021 and further to between 22 percent and 35 percent by December 2021,” said Prof Ncube.

He said the prevailing price and exchange rate stability would also go a long way in supporting industry players in making long-term investment decisions and allowing for the efficient allocation of resources.

Treasury and the Central Bank, said the minister, will continue to pursue strong monetary and fiscal policies that sustain the current disinflationary path.

“The Central Bank has continued to implement the monetary targeting framework which balances the need to sustainably anchor inflation expectations and simultaneously provide appropriate levels of liquidity in support of economic activity,” he said.

“The monetary targeting framework has helped to contain money supply growth, which in turn has stabilised the exchange rate and eased inflationary pressures in the economy.”

In 2021, Prof Ncube said reserve money growth target per quarter was lowered from 25 percent in 2020 to 22.5 percent in order to send a strong signal to the market that the Government will do whatever it takes to stabilise the economy.

He told the August House that the banking sector remained adequately capitalized, with aggregate core capital of $64.21 billion as at 31 March 2021, an increase of 20.74 percent, from $53.18 billion as at 31 December 2020.

On balance of payments, Prof Ncube said despite the transitory current account deficit realized during the first quarter of 2021, Zimbabwe’s current account balance for 2021 was projected to remain in a surplus position at a moderated level of US$611.6 million, compared to US$1 096 million recorded in 2020.

He projected merchandise exports to jump by 4.2 percent from US$4 931.9 million in 2020 to US$5 139.8 million in 2021. Similarly, mineral exports are expected to maintain strong growth on account of the continued strong performances mainly in Platinum Group of Metals (PGMs) and recovery in chrome and high carbon ferrochrome exports.

Prof Ncube projected that merchandise imports would also increase by 11.1 percent to US$5 245.7 million in 2021, from US$4 719.9 million in 2020. However, food imports would be lower on account of reduced maize imports, following a good 2020/21 agricultural season, he said.

Diaspora remittances remain a major source of foreign exchange in the economy and between January and June 2021, the country received US$746.9 million compared to US$288.7 million during the same period last year.

As such, Prof Ncube said remittances would continue to drive the current account surplus in 2021, with end year projection of US$1.3 billion.

The 2021 National Budget was premised on revenue projections of $390.8 billion (16.4 percent of GDP) and expenditures of $421.6 billion (18.2 percent of GDP) with a targeted budget deficit of $30.8 billion, which is -1.3 percent of GDP.

On this, Prof Ncube said the first half-year budget execution indicates continued dividends from the fiscal consolidation measures being pursued since the Transitional Stabilisation Programme.

To that end, he estimated revenues for the period January-June 2021 at $198.2 billion, whilst expenditures were about $197.6 billion, resulting in an almost balanced budget position, with a small surplus of $570 million. The positive performance was attributed to both tax and non-tax revenues, which were above targets by 5.3 percent and 392 percent, respectively.

“Overall expenditures during the period January to June 2021 stood at $197.6 billion, implying expenditures were above the half year target of $189.8 billion by $7.8 billion,” said Prof Ncube.

“Major expenditures were on compensation of employees at $80 billion against a target of $73.8 billion and non-financial assets (capital budget) at $67.4 billion against a target of $58 billion.

“Social benefits and subsidies stood at $14.5 billion and $2.9 billion, against the half year targets of $6.1 billion and $1.4 billion, respectively.”

On the outlook to December 2021, Prof Ncube said the targeted budget expenditure of $421.6 billion will be maintained, save for exigencies managed through re-allocations, where necessary.

In view of the persistent Covid-19 pandemic, the Treasury boss said intensive vaccination remains un-avoidable as a long-term solution to saving lives and livelihoods.

To date, resources amounting to US$93.2 million from the US$100 million set aside for vaccines acquisition has been spent, he said.